Context for Chatgpt:

The growth and drawing cycle of bitcoin course has so far been dominated mainly by a reduction event by half (or half) of BTC prices for a crippo of a minor. Since 2024, however, this cycle seems to be disturbed by an increasingly strong link to the crypto market for traditional financing.

CEO of the cryptocurrency questioned this cycle in question, although the Bitcoins (BTC) course is maintained above the threshold of $ 100,000. In fact, the first of Kryptos currently benefits from institutional interest and macroeconomic trends.

Ki Young Ju challenges the theory of bitcoin cycles

CEO of the cryptocurrency, Ki Young Ju, admitted that his previous prediction that the cycle of Bitcoin’s bruises ended two months ago was actually wrong.

“Two months ago, I said that the bull cycle was over, but I was wrong. The sale of bitcoins is falling and in the past there are important incoming flows in the past, the market was quite simple (…), old whales, minors and private investors were a relay,” he wrote.

The CEO informs this feeling, while the actors of traditional financing (Tradfi) such as ETF (negotiated funds on the stock market), and institutional investors disturb the dynamics of the digital assets market. According to ETF and Microsthega cryptocurrency manager (now renowned strategy) and institutions are rebuilt cards in this industry.

In the past, BTC On-Svezec analysts watched reserves of minors, the movements of the whale and the incoming flows of individuals to identify the peaks of cycles.

According to KI, the system worked well when everyone was in a hurry to go at the same time. Today, however, these indicators lose meaning. The strategy is now holding 555,450 BTCs when it recently increased its participation to 1,895 BTC purchased for $ 180.3 million.

The company’s Bitcoin assets increased by 50.1 % thanks to long -term storage strategies and permanent institutional beliefs, not because of cyclical timing.

The arrival of Bitcoin’s ETF in cash in the United States and the increase in the world’s allocations in Tradfu have committed analysts to revise their evaluation of liquidity flows.

Beinkrpt’s English branch also reported that ETF based in the United States has In May, he recorded a significant return of clean entrance flows and powered by bitcoins over $ 100,000. This progress has helped destabilize the traditional themes of cycles, a structural change that KI also emphasizes.

“We have the impression that it is time to throw this cycle theory in the trash … Now, instead of fearing old whales that are sold, it is more important to focus on the amount of new liquidity of institutions and ETF,” said cryptocurrency analyst.

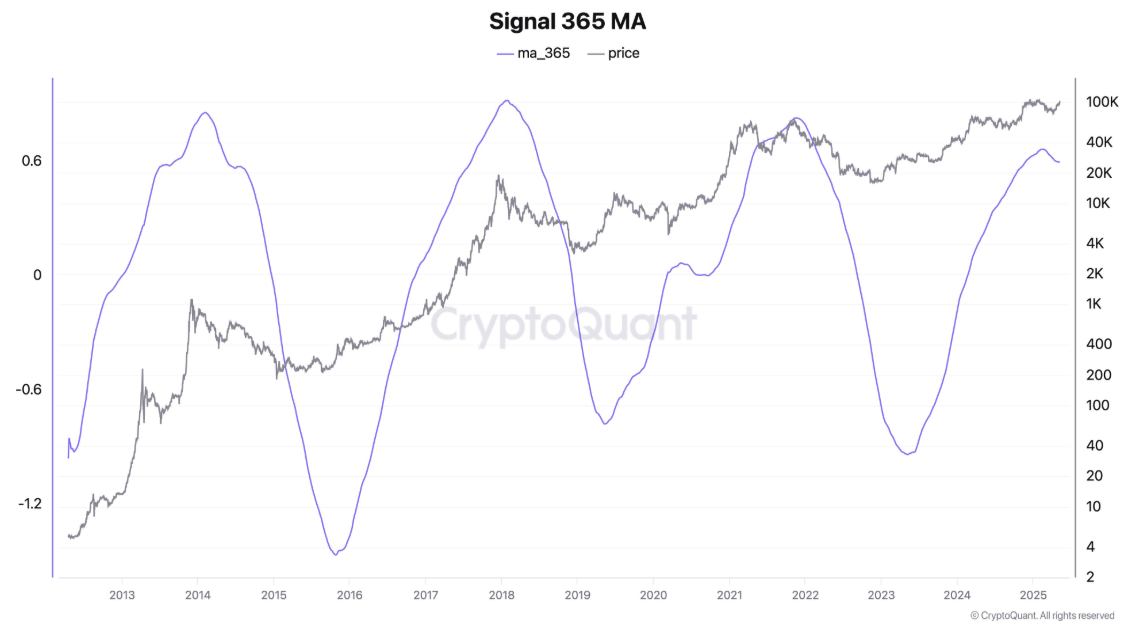

However, JU insists that the data on the chain retains the analytical value. In particular, it quotes the graphics of 365 mA as a long -term barometer. This indicator monitors the deviation of a bitcoin course compared to its mobile diameter after 365 days.

However, even this model, which previously framed cyclic extremes, is now fighting for new variables and showing signs of Reading.

On X, Kyledops, on X, noted that the Bull Bear cryptocurrency indicator has just gained its first ascending value from February, albeit weakly, while the BTC found a mark of $ 100,000.

“30dma is straightened. Crossing over 365dma has historically caused a significant increase. This does not mean anything or everything at all,” he said.

In addition to graphic signals of macroeconomic forces, they also accelerate the Bitcoin fusion with tradfi. Beincrypto said that Bitcoin is increasingly perceived as a coverage against the risk of US treasury accounts and devaluation of trust currencies. Traditional asset management circles are now sharing this feeling.

The Bitcoin market already disagrees with the old cyclical scheme. Analysts could be forced to modify their frames with ETF incoming flows, institutional reserves and growing tradf imprint.

“Just because I was wrong that the data on the chain is unnecessary. The data is only data and the perspectives are different. I will try to provide better quality analysis in the future,” Ju concluded.

This perspective therefore suggests that the Bitcoins market matures, and while Tradfi gradually takes reins, its operation is rewritten simultaneously.

Morality History: The crypto cycle is not eternal.

Notice of non -responsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to check their own facts and consult a professional before you decide on the basis of this content.